Exciting news: Brizo FoodMetrics has been acquired by Datassential! Learn more.

The way you market in the foodservice industry comes down to what type of business you are targeting. There’s a big difference between small independent restaurants with a single location and large F&B chains with multiple outlets.

Let’s explore the unique characteristics of each group and how marketing and selling to small restaurants vs large operators can differ.

The restaurant industry is incredibly diverse. Every establishment, from large to small, has its own way of doing things. Small independent restaurants, in particular, offer experiences that are as unique as the people running them.

These small, standalone establishments are shaped entirely by their owners. The owner’s personality and vision influence the menus, ambiance, branding, and other facets of the business. Management often consists of family or a tight-knit team.

And since these restaurants are not bound by strict corporate rules, they can quickly adapt to market trends and what their customers want.

Independents are also characterized by limited budgets, tight margins, and the constant pressure to stand out in a competitive market. Understanding these nuances can help you become the partner these restaurants lean on for long term partnerships.

Walk into two locations of the same franchise, and you’ll notice that the menu looks the same, the service is consistent, and even the decor doesn’t change much. That’s no coincidence: large food and beverage operators are built on delivering a uniform experience across all their outlets.

This consistency is the result of highly controlled systems where the parent company dictates everything, including menus, branding, how staff are trained, and which manufacturers and distributors they work with.

Large F&B operators are highly valuable clients for distributors because their orders are often predictable and consistent. However, breaking into this market can be tough, because these F&B giants often have strict supplier standards, routine audits, and a heavy focus on maintaining uniform quality.

The good news is: once you secure a spot in a chain’s supply chain, you’re in for significant, repeatable returns.

By now, you’ve seen fundamentally different independent vs chain establishments are. Here’s an overview of factors that you should consider when marketing to each segment.

Small independent restaurants operate with tight budgets, limited resources, and fierce competition. Every decision matters, and personal relationships can make or break a supplier agreement.

On the other hand, large food & beverage operators face complex supply chain management and high-volume expectations, requiring efficiency at scale. Their focus is on consistency, cost-effectiveness, and reliability.

For independent restaurants, decisions are often made based on personal relationships and trust. They value suppliers who offer flexibility and tailored solutions.

In contrast, large operators prioritize efficiency and data-driven strategies, requiring suppliers who can scale operations, streamline logistics, and optimize costs.

Order sizes differ drastically between these two segments. Small restaurants place flexible, seasonal orders, often adjusting based on immediate demand.

Large chains commit to bulk purchasing and long-term contracts, ensuring a steady supply for multiple locations and optimizing cost per unit.

Small restaurant owners rely heavily on local networking, community events, and social media outreach to discover suppliers and build partnerships. They appreciate a hands-on approach, direct communication, and localized support.

In contrast, large operators engage at the corporate level, attending trade shows, industry expos, and negotiating through formal RFP processes. Their decisions are often data-backed and require detailed presentations and cost-benefit analysis before committing to a supplier.

Reaching these two audiences requires different marketing approaches. For small restaurants, social media, email campaigns, local SEO, and in-person visits are the most effective ways to build trust and awareness.

Meanwhile, large operators respond to structured, data-backed presentations, co-branded campaigns, and formal procurement discussions that align with their strategic goals.

Whether you’re targeting small independent restaurants or large food & beverage operators, aligning your approach to their specific challenges, engagement preferences, and decision-making processes can make all the difference.

For small businesses, prioritize relationship-driven interactions and flexible solutions. For large operators, focus on efficiency, scalability, and strategic value.

Whether you’re marketing to small independent restaurants or large food & beverage operators, success starts with knowing your prospects inside and out. But here’s the challenge. How do you get the comprehensive, accurate data you need to truly understand the market?

You could try DIY methods, but let’s be honest. They’re time-consuming, expensive, and nearly impossible to scale. Meanwhile, buying contact lists can only get you so far: out of thousands of faceless names and emails, how do you know which ones to prioritize as a good fit for your business?

The smarter solution is Brizo FoodMetrics, a market intelligence platform designed to give food and beverage distributors access to a comprehensive restaurant database filled with critical insights.

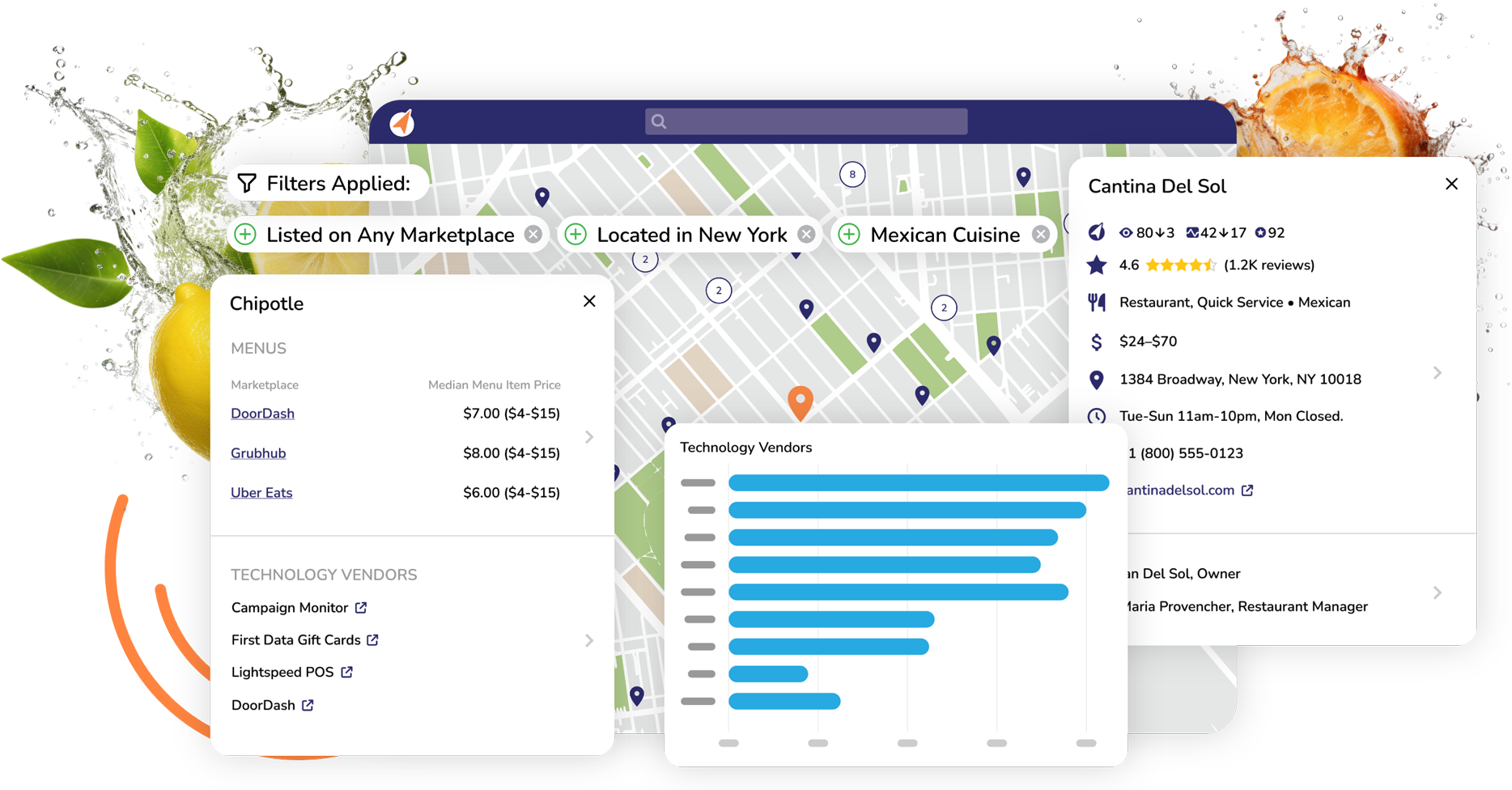

Brizo FoodMetrics provides access to a restaurant database with information on over 2.1 million foodservice establishments across the US, Canada, UK, Ireland, Australia, and New Zealand. From full-service restaurants and cafes to bakeries, food trucks, bars, and QSRs, Brizo ensures you can target both small independent businesses and large-scale foodservice operators with precision.

Unlike generic contact lists, Brizo’s restaurant database lets you filter by geography, menu items, cuisine type, and even what restaurant technologies are in use. You can even filter by chain name and chain size to create dedicated campaigns for independents versus larger operators.

With weekly data refreshes, you can trust that you’re working with the most up-to-date restaurant data available, ensuring your outreach and decision-making are always backed by real insights.

Stop wasting time on outdated or incomplete data. With Brizo FoodMetrics, you get access to a restaurant database designed to help you find, understand, and engage with the right foodservice businesses—faster and more effectively.

Your free trial is waiting! Sign up today and start marketing to restaurant owners with a higher success rate.