Exciting news: Brizo FoodMetrics has been acquired by Datassential! Learn more.

Competition in the restaurant technology sector is reaching a boiling point. Since COVID, restaurants have been hammered with rising food costs and record inflation. In response, operators have been growing their tech stack to help optimize front- and back-of-house performance, control costs, and improve customer experiences.

In fact, 76% of restaurant operators expect to increase their technology spending in 2024, according to the latest Restaurant Industry Report by Houlihan Lokey.

From third-party delivery apps and sophisticated POS systems to loyalty programs and online reservation services, the number of tech services being adopted by restaurants is growing exponentially.

And so is competition within the market. Where there were only a handful of players in this space a decade ago, today, the restaurant technology industry is stacked with hundreds of vendors hungry to get the biggest slice of the pie. The global restaurant management software market is projected to surge from $5.7 billion USD in 2023 to approximately $26.3 billion USD by 2032, with a robust Compound Annual Growth Rate (CAGR) of 16.5%, according to a market.us report published earlier this year.

So, how do restaurant tech companies rise above the competition and dominate their category? How do they identify and target the prospects most likely to use their products? And how do they ensure their sales efforts are as efficient as possible to avoid wasting time and resources and missing potential opportunities?

The old approach of sales prospecting for restaurant tech vendors just isn’t efficient: manual research is far too time-consuming, while purchased data lists often only provide basic contact information and lack key insights to help inform strategic decision-making.

Read our data decay blog post to learn how stale CRM data might be bogging down your sales and marketing operations.

Having the right foodservice data, insights, and intelligence is key to streamlining your prospecting strategy and maximizing your sales growth for higher conversion rates.

Here’s how restaurant technology vendors can harness the power of insight-led data to identify and close more deals.

Before diving into the data, it’s important for restaurant tech vendors to clearly define their sales objectives. Whether it’s expanding into new markets, scaling your business or increasing market share, defining your goals first will help you understand what data and insights you need to drive your decision-making.

It’s also important to determine whether you’re targeting multiple new clients (which requires scalable tactics) or focusing on account-based marketing (ABM) (which relies more heavily on personalization). For many new res tech vendors, understanding their Total Addressable Market (TAM) and Ideal Customer Profile (ICP) is the first step in effectively planning their go-to-market strategy.

Read our Opus case study to learn how Brizo helps them visualize their addressable market and find tech-savvy, multi-unit prospects.

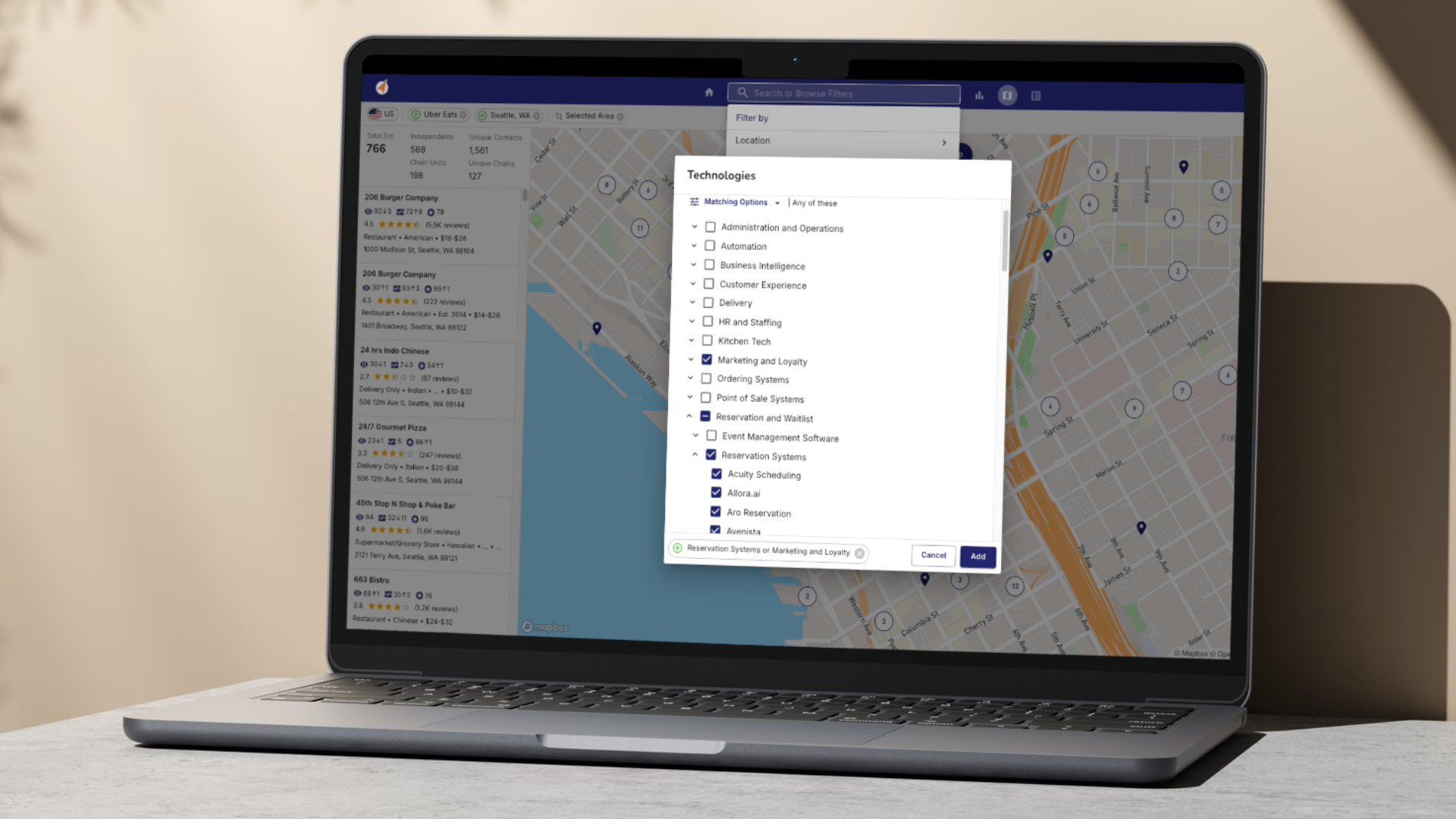

Understanding what tech tools and platforms prospective clients are already using – like delivery marketplaces, online ordering systems, POS platforms, reservation systems and loyalty programs – is a critical part of effective prospecting.

If a restaurant uses several advanced technologies to manage its operations, it indicates a certain level of technological sophistication. Tech-savvy establishments will be a stronger fit for your offering because they’re more likely to quickly understand the benefit of what you’re selling compared to a more low-tech restaurant. On the flip side, knowing which establishments use little to no modern technology offers a chance to be the first to capture their business with a tailored, “beginner-friendly” sales approach.

If a restaurant uses a competitor’s product, this is the perfect opportunity to launch a targeted sales conquest campaign showcasing the unique benefits and advantages of switching to your product.

If platform stacking is available (where a restaurant uses multiple competing services simultaneously, like listing on more than one third-party delivery app), you can target your pitch to focus on the benefits of platform diversification, including expanding reach, reducing risk and enhancing flexibility.

Some providers also specialize in technology designed to unify multiple ordering systems into a single streamlined platform. For these companies, identifying establishments juggling multiple services makes it easier to target those that would benefit from integration.

Read our DAVO case study to explore how different technologies can be used as a clever proxy for elusive POS system data.

Tech stack isn’t the only thing to consider when targeting potential foodservice clients. There are a number of other factors to look at, including:

Read our ezCater case study to see how they use Brizo to identify lookalike accounts and expansion markets.

When a digital experience is personalized, B2B prospects and customers are four times more likely to progress in their buying journey, according to a report by ON24. Gathering this data about restaurant operators allows your sales teams to target and personalize their outreach and prospecting campaigns. They can craft different messaging that speaks directly to a restaurant operator’s pain points, business needs or technology systems.

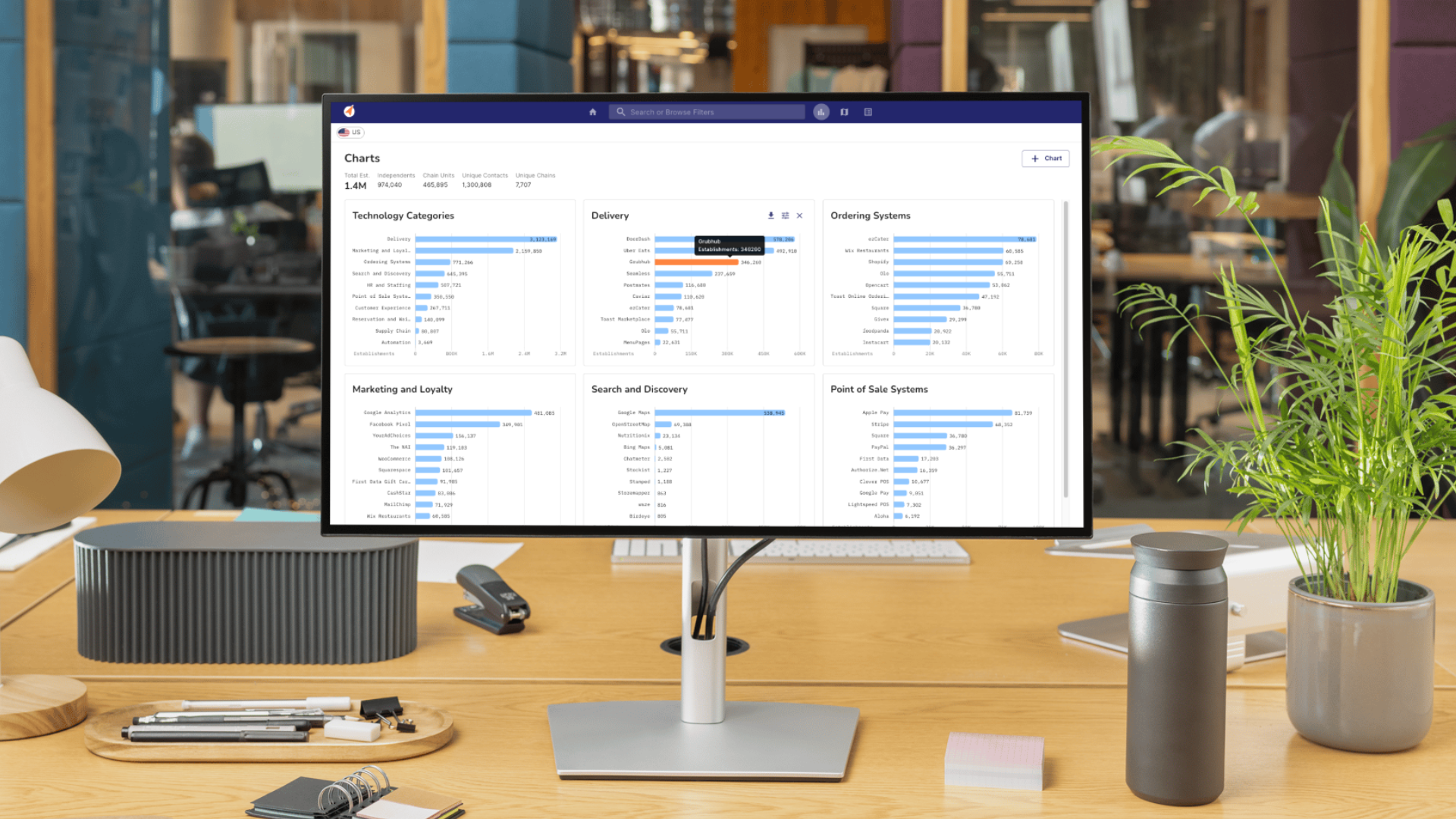

Brizo’s market intelligence platform offers rich data on more than two million foodservice establishments, including usage of over 1,100 restaurant technologies at the operator level. In just a few clicks, users can dive into what marketplaces a restaurant is listed on, confirm how many locations they have, see monthly website and foot traffic, and so much more.

Robust dashboard and mapping tools within Brizo FoodMetrics make it easy to visualize the market and focus on your biggest opportunities. This insight-led data will provide a complete view of your prospects and help accelerate your sales process.

Ready to start targeting establishments who are the strongest fit for your restaurant tech? Sign up for a free trial of Brizo FoodMetrics and start streamlining your sales efforts today.