Challenge

Upper Crust Enterprises is no stranger to innovation. Founder Gary Kawaguchi toured Japanese factories in the 1980’s to study traditional methods of making panko (Japanese bread crumbs) and source equipment to become the first panko manufacturer in the US. As they continue to scale globally, Upper Crust Enterprises needs to be strategic about where to focus their time and resources. They require a deep understanding of the foodservice market to identify their biggest opportunities and steer more efficient, effective sales and marketing campaigns.

Solution

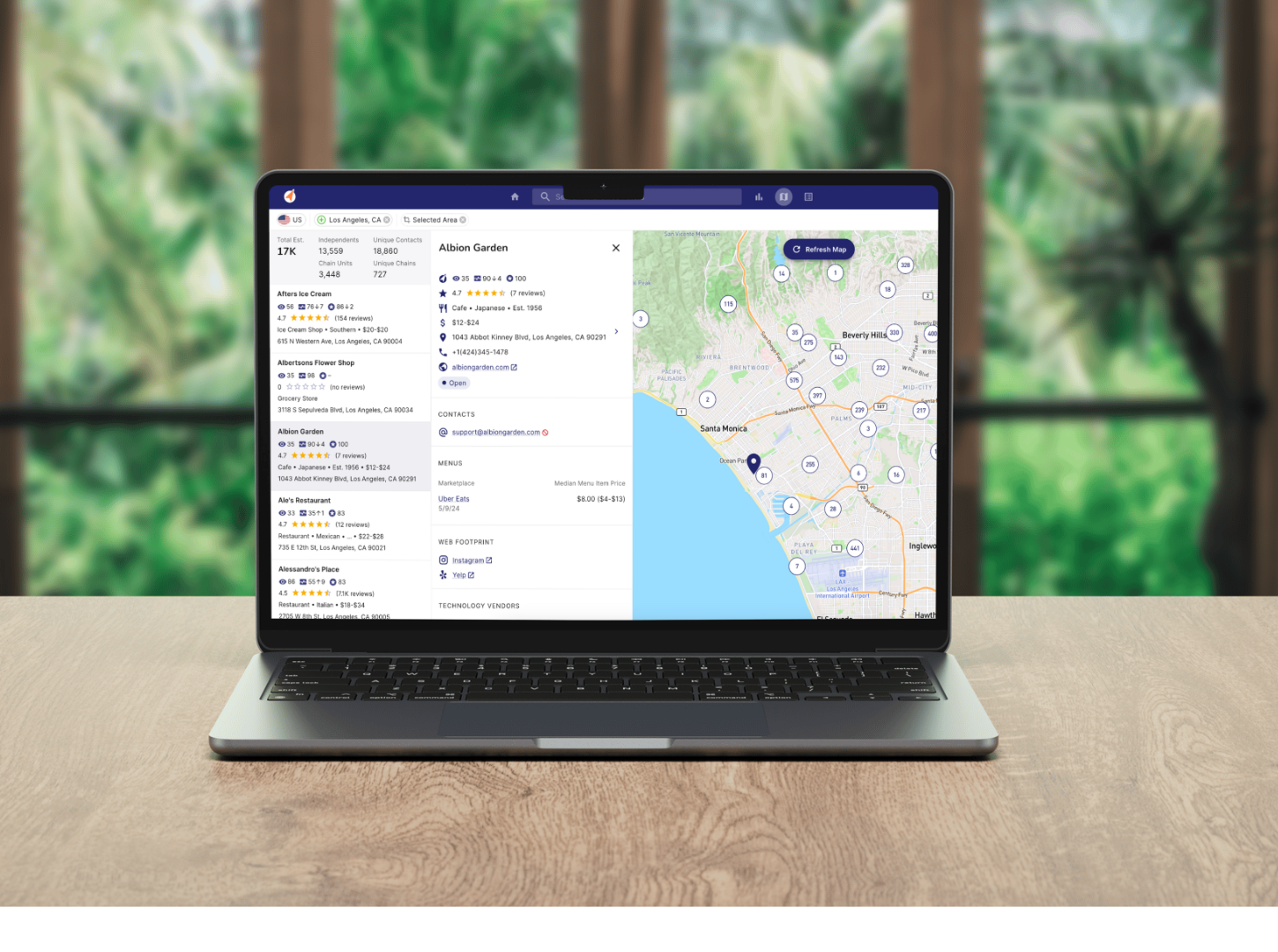

With Brizo, Upper Crust Enterprises has tapped into the actionable insights needed to successfully meet both macro and micro goals. Despite trying other market intelligence providers, Upper Crust Enterprises chose Brizo FoodMetrics for its affordability and ease of use. They have hailed Brizo as especially intuitive and beneficial for small to mid-sized businesses without the dedicated resources of larger teams.

Impact

Maximize TAM visibility for strategic growth

Upper Crust Enterprises needs visibility into the entire foodservice industry to evaluate their Total Addressable Market (TAM). Before Brizo, they conducted their own ad-hoc online research to find and map potential prospects—a time-consuming process with mixed results. They also received market intelligence from their broker, which could quickly become outdated due to the fast-moving nature of the foodservice industry.

Deploying a more holistic market research process has helped erase risky blind spots and fundamentally change how their business operates. By applying a range of establishment filters within Brizo, Upper Crust Enterprises can quickly investigate different segments of their target audience. The “fried food” filter reveals their TAM at its highest level: after all, panko makes every fried item better! Diving deeper, they can filter by Japanese cuisine or conduct a dish- and ingredient-level search for operators already using panko or tempura on their menu.

This depth of market intelligence has helped paint an accurate picture of the size of the market and their largest growth opportunities. Because Brizo FoodMetrics data is refreshed every 30 days, they can make strategic business decisions with full confidence.

Prospect with precision to engage key operators and drive demand

For Upper Crust Enterprises to grow their business in existing markets, they meet with prospective customers to showcase their products and drive orders through current distribution partners. To enter new markets, they must demonstrate proof of demand to their brokers in order to expand product availability across distributors.

To zero in on high-potential establishments, Upper Crust Enterprises uses Brizo’s aggregated rating and review data as a proxy for customer traffic. (They were also quite excited to learn that foot traffic is coming soon to Brizo!) By focusing on establishments with high volumes of positive reviews, they can disqualify low-quality leads and minimize wasted resources.

Conducting their own market research has also unlocked a unique industry advantage: they can now provide their own insights to brokers and confidently advocate for themselves in the market. Accounts of interest are analyzed in Brizo and overlaid with their broker’s market intelligence to develop a well-informed strategy for more efficient and effective sales.

This market intelligence is also valuable internally. When questions around their market and business potential arise within the organization, Brizo’s insights are available to enlighten and guide the entire team.

“With market intelligence from Brizo, you can stake your own flag in the sand: you’re not always relying on someone else to give you that information.”

Jeff Hill

VP of Sales & Marketing at Upper Crust Enterprises

Quantify return on investment

Prior to using Brizo, one third of Upper Crust Enterprise’s sales calls were considered low-value due to various prospect factors (lack of product relevance, too small in scale, and so on). After leveraging Brizo to focus on high-quality prospects, their team has reduced the number of low-value calls by 50%, improving their sales efficiency by 16%.

With $100 of resources consumed per call, those savings have the potential to add up quickly, and it’s easy to justify Brizo’s return on investment. For example:

- Daily Savings: $100 (from reducing low-value calls by one per day)

- Annual Savings: $26,000 (assuming 260 working days per year)

Target ideal prospects with direct-mail samples

For an upcoming direct mail sample campaign, Upper Crust Enterprises is using Brizo to identify high-quality prospects who fall within their distribution coverage and already use panko and tempura on their menu.

Their sample campaigns educate operators on the benefits of authentic panko and let them try it for themselves: due to its unique proofing and baking process, their panko contains microscopic holes that help it stay light, airy, and crisp when fried while simultaneously preventing excess oil absorption.

Overall, this targeted approach helps avoid resource waste while maximizing conversion potential.

Ready for a taste of Brizo’s fresh insights?

Our market intelligence platform has everything you need to dive into foodservice industry insights and start making data-driven decisions.

Start Trial