Exciting news: Brizo FoodMetrics has been acquired by Datassential! Learn more.

Founded in New York City in 2004, Grubhub dominated the early third-party delivery (3PD) market and were one of the first of their kind to IPO in 2014. They were later acquired by Netherlands-based Just Eat Takeaway (JET), Europe’s largest meal delivery company. With operations around the world — from Skip in Canada to Menulog in Australia — JET purchased Grubhub in a play to expand into the US, with the deal announced in June 2020 and closing in June 2021 for $7.3 billion USD.

Just 10 months later in April 2022, it was confirmed that Just Eat Takeaway was exploring options to sell the recently acquired Grubhub business. In November 2024, Grubhub was sold to virtual food hall provider Wonder for a meager $650 million USD: a stunning loss of over $6.5B in less than four years. What could have transpired in such a short period of time to drive such disappointing results?

We analyzed foodservice market data from Brizo FoodMetrics to help visualize Grubhub’s steep drop in valuation.

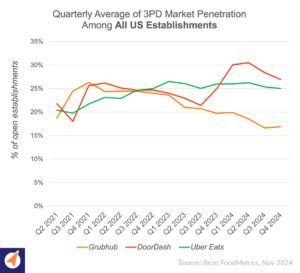

This chart shows the percentage of US foodservice establishments listed on each of the “big three” third-party delivery providers in the US: Grubhub, DoorDash, and Uber Eats. It captures the percentage of open establishments that partnered with these platforms over time (by quarterly average), providing insight into the competitive dynamics of the 3PD market.

How to read this chart:

Each line shows the percentage of open foodservice establishments partnered with a specific provider (Grubhub, DoorDash, or Uber Eats). If every establishment in the market partnered with DoorDash, its line would reach 100%.

However, since restaurants often list on multiple 3PD platforms, percentages can overlap. For example: if 100% of establishments use DoorDash, and 67% of those also use Uber Eats, DoorDash’s line would be at 100%, while Uber Eats’ would be at 67%.

This means that the percentages reflect the use of each 3PD provider by establishments, not exclusive partnerships.

Even at a glance, Grubhub’s downward trajectory is clear to see. At the time of their acquisition by Just Eat Takeaway in Q2 2021, they were holding their own against their rivals. Almost immediately after, their market penetration began to dwindle. Fast forward to Q2 2022 and it’s not surprising that JET was trying to unload a quickly depreciating asset, which took another couple of years to sell — at which point it was worth 90% less than what they had paid for it.

Other events of note in Grubhub’s timeline:

When the original JET deal was announced in June 2020, food and grocery delivery was booming: Covid-19 lockdowns and social distancing meant consumers were eager to have goods appear at their doorstep.

Though a rising tide lifts all boats, geographic differences between providers at the outset of the pandemic set some up for greater success. As consumers fled dense downtown neighbourhoods, delivery demand shifted to suburban areas — where Grubhub was “definitely in third place,” according to a former senior-level director. Though Grubhub had a strong presence in urban areas, when the tables turned, they took a hit while Uber Eats and DoorDash capitalized on suburban opportunities.

Failure to adapt and innovate fast enough could be another element of their downfall. Despite a series of acquisitions by Grubhub between 2015 and 2018, these new technologies weren’t well-integrated with the Grubhub platform. In comparison, DoorDash built many of their own tools in-house and took a more seamless approach to integrations, which benefited consumers, establishments, and venture capitalists alike.

Grubhub fell even further behind as its competitors took leaps into new verticals like groceries, drugstore goods, and pet supplies. While Uber Eats brought Costco on board and DoorDash partnered with Walmart and convenience stores, Grubhub remained reluctant to expand outside food delivery.

In your opinion, what other factors played a part in the 3PD market battle? Share your thoughts in the comments.

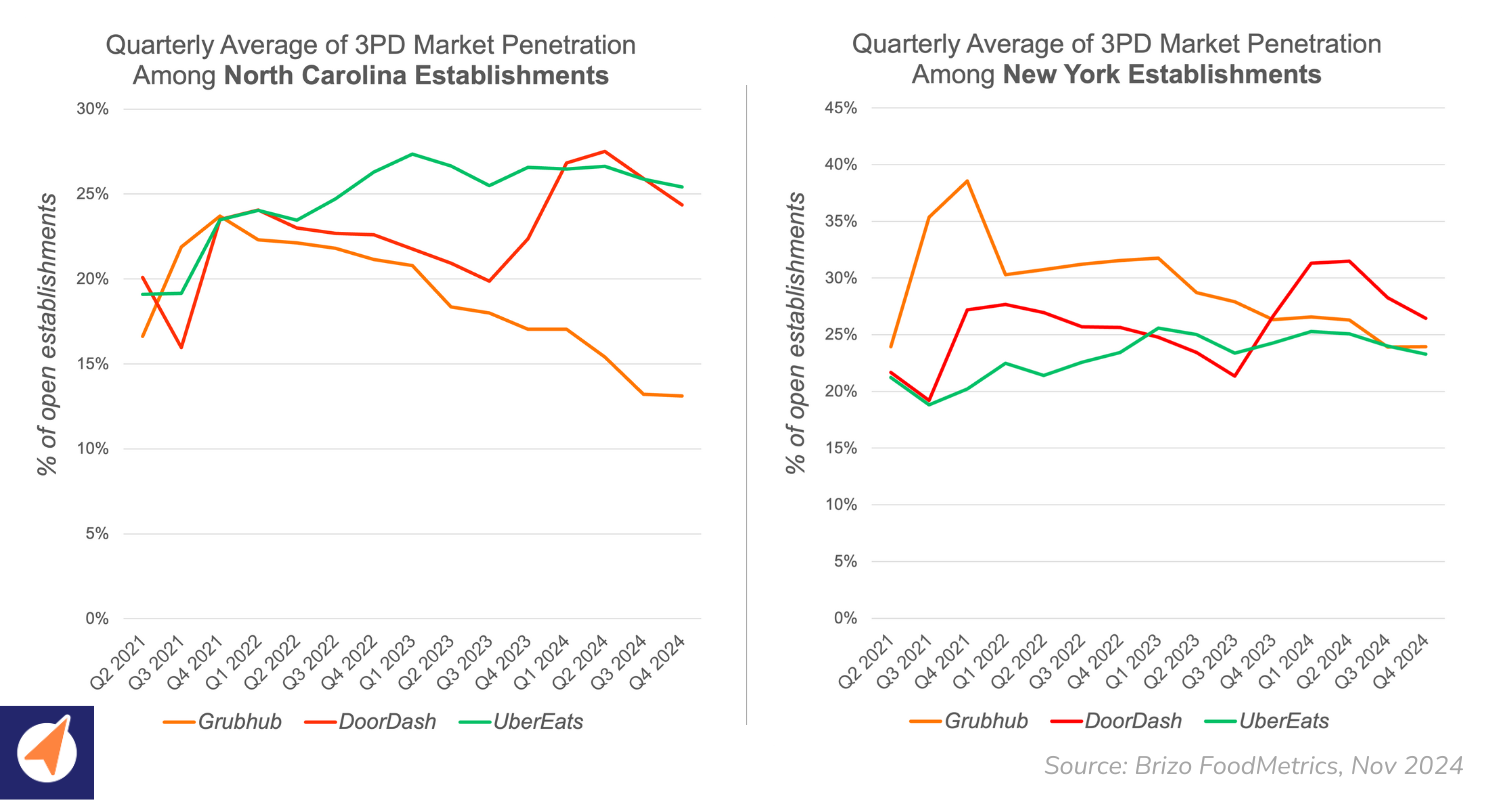

To explore regional differences in 3PD market penetration, we also ran the same analysis by state. Let’s compare the two charts below for North Carolina and New York.

In North Carolina, all three providers were neck and neck in Q4 2021. Three years later at the end of 2024, Uber Eats and DoorDash remain locked in fierce competition, while Grubhub continues to fall further behind.

Looking at New York, Grubhub was actually leading the pack between 2021 and 2023 before slipping behind DoorDash. In 2024, all three 3PD providers continue to battle it out, with market penetration relatively even but DoorDash narrowly ahead.

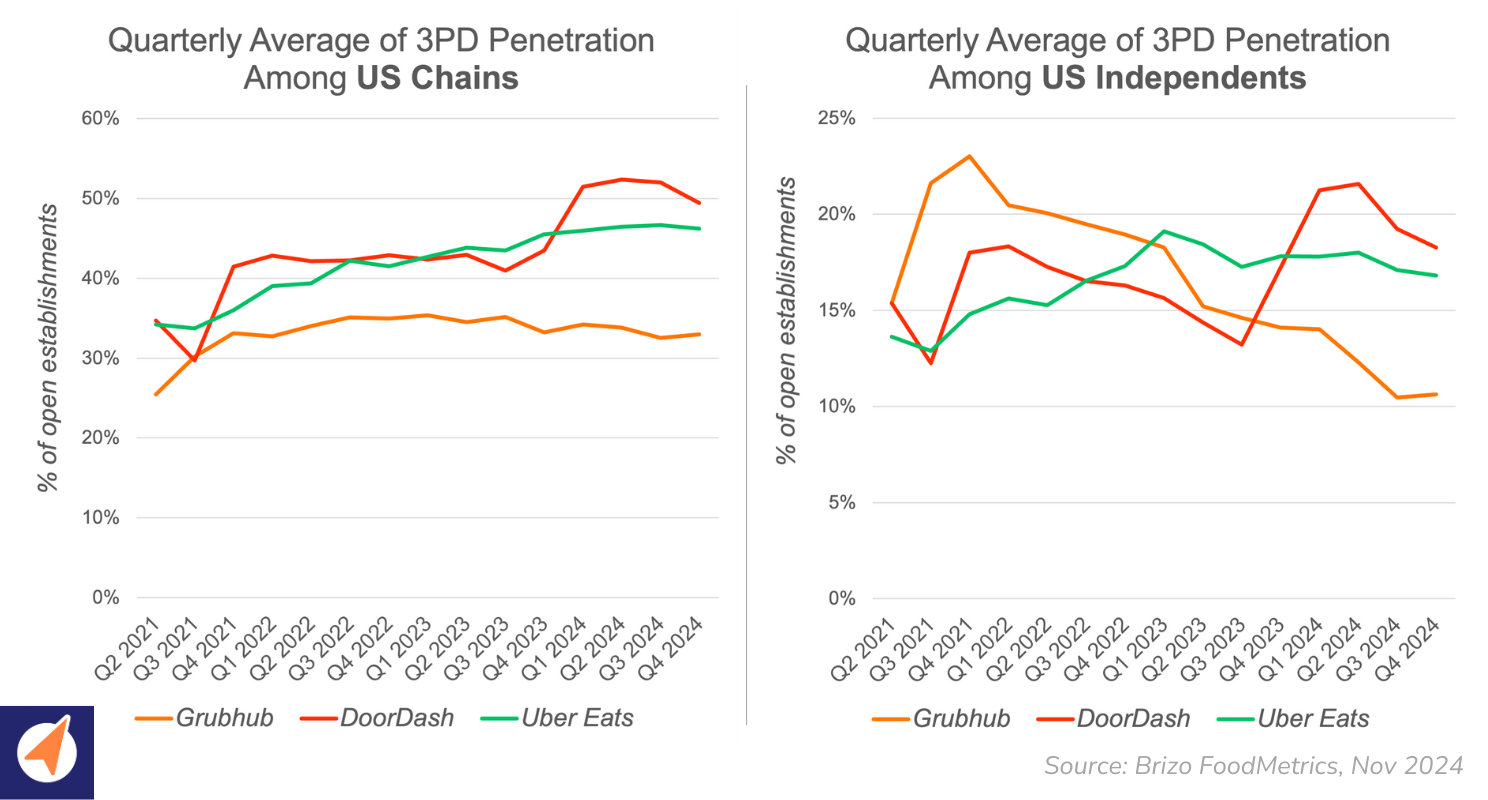

Visualizing another angle on 3PD, let’s look again at US-wide data, this time split by chain and independent establishments (where a chain is considered 4 or more locations).

We can see that Grubhub was the vendor of choice for independents between mid-2021 to the end of 2022, at which point their market penetration in this segment took a nose dive and never recovered. For chains, meanwhile, Grubhub has lagged behind UberEats and DoorDash since 2021, though their performance in this segment has been more stable over the last couple of years compared to the significant drop seen with independents.

This data presents a few interesting observations around 3PD usage in general:

Grubhb’s new owner — Wonder, a virtual food hall provider founded by former Walmart exec Marc Lore — also has roots in New York City. After launching in 2018 as a food truck delivery business, they later pivoted to brick-and-mortar establishments with their own delivery and pickup app. Wonder raised $700M USD earlier this year, bringing their total funding up to $1.7B USD, and they plan to grow to 90 locations by the end of 2025 (concentrated in the Northeast region). As part of the acquisition, Wonder will take on $500M USD of Grubhub’s debt.

Wonder has a history of acquiring struggling companies with the hope of turning them around: in 2023, they purchased meal kit company Blue Apron after their share prices dropped by 99% following a 2017 IPO. Blue Apron kits are now available within Wonder’s app for pickup or delivery.

Back to Grubhub: in a press release, Wonder CEO Marc Lore cited the acquisition as “the next step in our vision to create the super app for meal time, re-envisioning the future of food delivery.” He also indicated plans to expand the Wonder app to offer a selection of Grubhub restaurant partners alongside their own restaurants and meal kits.

Will they be successful? That remains to be seen. As highlighted in the New York state data above, the 3PD market is still fiercely competitive. With Grubhub now back under NY-based ownership, the company has an opportunity to refocus on its home territory and intensify its efforts in the markets where it initially thrived.

What do you think of Grubhub’s rise and fall? Are they poised to deliver another wave of market dominance, or will Wonder’s latest purchase become a forgotten order, left waiting on the counter for a pickup that never comes?

Brizo FoodMetrics is the leading market intelligence platform for foodservice suppliers and vendors, covering over 2.1 million establishments across both chain and independent locations in six countries. We collect and aggregate fresh, precise data from over 500K diverse sources, including the digital footprint of the foodservice industry.

Our robust platform provides a comprehensive view of establishments, covering everything from menu items and cuisine types to technology adoption, services, and amenities. These granular insights enable clients to generate higher quality leads, achieve up to 50% higher conversion rates, and enhance market clarity.

A note on this data: The foodservice market is constantly evolving, and Brizo FoodMetrics captures new data daily to reflect these changes. While some fluctuations in the numbers may occur, they reflect the dynamic nature of the industry. The broader trends and key insights shared remain highly accurate and provide a reliable view of market dynamics.