Exciting news: Brizo FoodMetrics has been acquired by Datassential! Learn more.

Menu data is the lifeline for food distributors. It’s the secret sauce that helps you understand what restaurants are serving and where your products might fit in. You can learn what ingredients and dishes are in use, understand pricing of different menu items, and more.

Many businesses struggle to access menu data. It’s not like you can Google every menu in town and call it a day.

In this guide, we’ll explore some options for finding and using restaurant menu data effectively. By the end, you’ll have actionable steps to get what you need. Let’s dig in.

Menu data can be the deciding factor between running a profitable supply business or sinking into losses. If you’re not using it, you’re leaving money on the table. Here’s how it helps:

There are several ways of menu data collection for your food supply business, but foodservice market intelligence tools take the crown. They’re efficient, reliable, and packed with features that make your life easier.

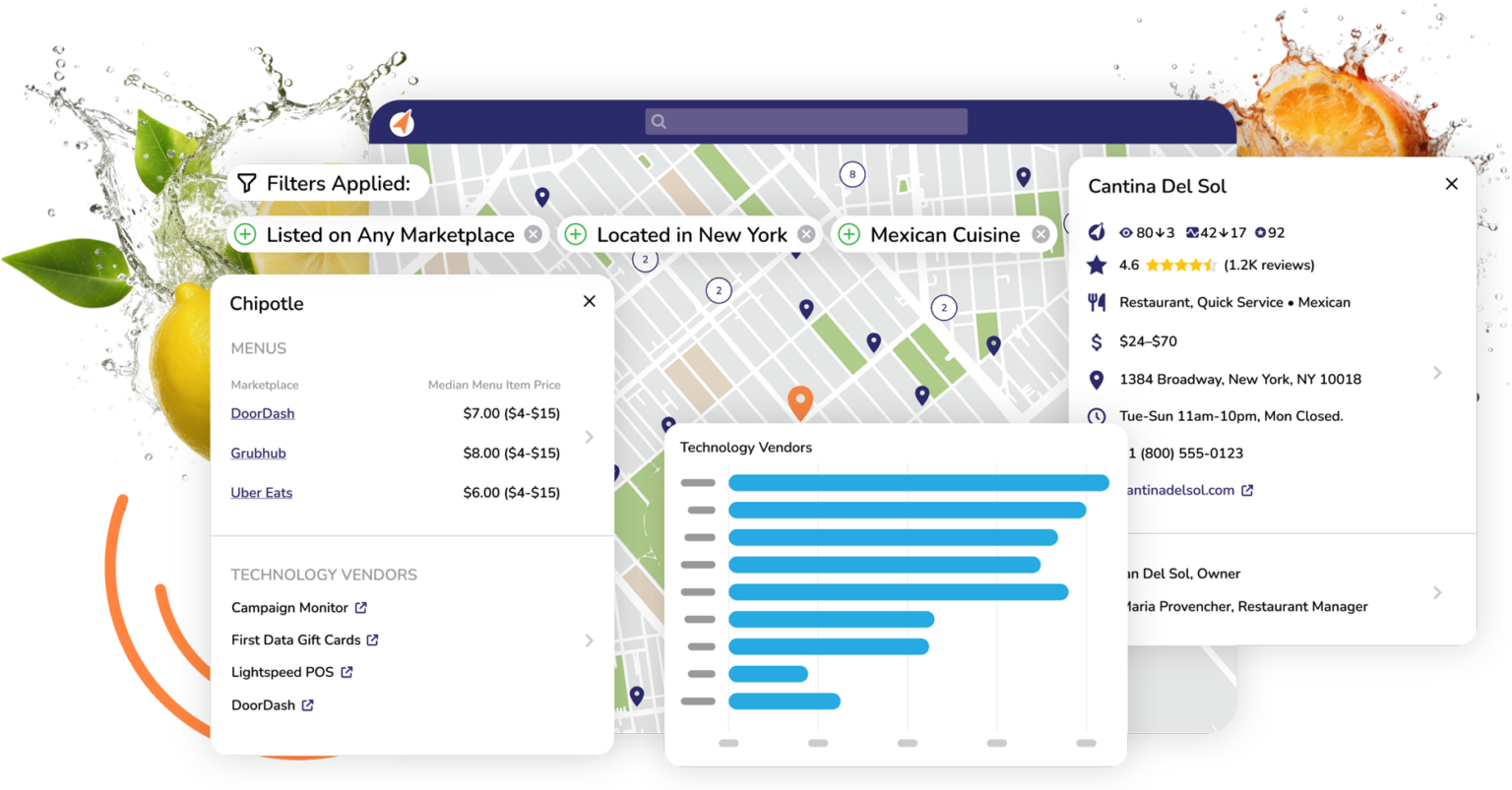

A foodservice market intelligence tool is a platform designed to provide detailed insights about food establishments, their menus, technologies, customer reviews, and more. For example, Brizo FoodMetrics is a market intelligence platform that offers menu data from over 2.1 million food establishments.

Brizo allows foodservice distributors to analyze this massive dataset to refine and target exactly what they need to focus on. Want to pull a list of restaurants that use a specific ingredient? Looking for locations offering a niche cuisine? Need to calculate the average price of a burger combo in a specific city? With Brizo, you can filter, visualize, and customize the data to fit your goals.

Market intelligence tools like Brizo have the power to keep the data fresh and updated in near real-time. They provide a centralized data system where you can access, track, and export information based on what matters most to your business.

For example, on Brizo, you can filter through:

One major advantage of using platforms like Brizo is that you have everything you need in one place, since it aggregates website and marketplace menu data into a single user-friendly tool. That means you can spend less time conducting manual research and more time digging into the menu insights you need to be successful.

By adding on historical data access, you can even conduct advanced analysis to:

Web scraping is a method used to extract data from websites. It involves using tools or scripts to gather information directly from restaurant websites or online directories, like food items and menu pricing. It’s similar to copying and pasting data on a large scale but with the help of automation.

While it sounds straightforward, it’s not always as simple as it seems for food and beverage companies. First, it requires technical know-how to set up and maintain scraping tools. If you’re not familiar with coding or don’t have someone on your team who is, you’ll need to hire an expert or invest in a reliable scraping service.

Restaurants also frequently update their menus—seasonal dishes, pricing changes, and new items always pop up. You need to continuously re-scape websites to avoid your data from becoming outdated. The resources required to run and maintain scraping infrastructure can quickly balloon to massive costs, making it infeasible for most businesses.

Third-party delivery services, like Uber Eats, DoorDash, or Grubhub, can give you access to restaurant menus, pricing, and even customer feedback. They’re a good starting point if you’re doing basic research or just trying to understand what’s out there.

However, these platforms fall short when providing a complete picture of the restaurant industry, especially if you’re running a business. Not every food establishment is listed on every platform, which means you’re bound to miss key data.

Even if you find the restaurants you’re looking for, manually sifting through menus and food items individually is time-consuming and inefficient.

Market research firms or conducting surveys can be another way to gather restaurant menu data for distributors. These companies use surveys, interviews, and industry analysis to provide valuable insights tailored to your needs. However, this approach often has a hefty price tag for food suppliers.

A major drawback of market research firms and surveys is that they often only capture a small slice of the market. Opinion-based surveys are just that–people’s opinions–and may not be as accurate as the hard data provided by market intelligence platforms. Most research reports are also static—they’re a one-time market snapshot.

Menu data is the heart of your food and beverage business strategy. Without it, you’re guessing. Guessing leads to mistakes. And mistakes cost money.

With Brizo FoodMetrics’s restaurant database, you can stop guessing and start making smarter moves. You can identify gaps in the market and get a competitive edge over other foodservice businesses.

Sign up for your free trial today—no credit card required.