Exciting news: Brizo FoodMetrics has been acquired by Datassential! Learn more.

In this article, we’ll explore the latest updates to the 2024 Brizo Restaurant Tech Map, the most comprehensive list of foodservice technology solutions available today.

We’ll also cover notable mergers and acquisitions, highlight the key tech trends of 2024, and share the industry’s best source of foodservice market intelligence for those looking to supercharge their sales processes.

For those unfamiliar, the Brizo Restaurant Tech Map provides a bird’s-eye view of the restaurant tech industry in one easy-to-read guide.

View the full map to identify the industry’s top innovators and leaders, ranging from well-known brands to emerging companies offering exciting new solutions.

The 2024 Brizo Restaurant Tech Map is divided into ten tech segments, addressing every operational and management challenge operators face.

Let’s explore how these segments have evolved since 2023.

The most significant change to the 2024 Brizo Restaurant Tech Map is the consolidation of previous segments.

For instance, in 2023, “Point of Sale” and “Payments” were two separate categories—in 2024, they were combined into a single “Point of Sale Systems” category.

Under each segment, we’ve created a list of subcategories related to the segment title. This new organization makes exploring solutions easier and more efficient.

Though the number of Brizo Restaurant Tech Map segments have been streamlined in 2024, the restaurant industry tech market continues to experience significant growth. With the pandemic firmly in the rearview mirror and inflation calming down, we’re seeing many new companies enter the arena.

Let’s look at some examples of how Brizo Restaurant Tech Map segments have grown since 2023. We’ve highlighted some notable companies for you to explore.

Point of Sale Systems grew from 102 to 137 companies (POS and Payments merged)—check out:

Ordering Systems grew from 91 to 143 companies (Drive Thru added)—check out:

Management & Operations grew from 46 to 86 companies (previously called Inventory, Accounting & Purchasing)—check out:

HR & Staffing grew from 53 to 67 companies—check out:

Overall, from 2023 to 2024, the number of logos grew from 716 to 826 (with some companies appearing in more than one segment).

As tech and AI become more deeply ingrained in daily restaurant operations, we’ll consistently see an uptick in M&A as tech companies see the advantages of banding together or being absorbed by larger companies.

Additionally, companies are also hearing the cry of restaurant operators who struggle to manage multiple software programs simultaneously to complete daily tasks. Tech companies that merge and integrate their products can offer operators a more enticing multipurpose platform, helping relieve stress.

Here are the most recent notable mergers and acquisitions in the restaurant industry.

American Express recently announced two big acquisitions on the same day as they continue their expansion into the restaurant technology space.

Reservation system Tock joins Resy (another large reservation provider) under the American Express banner, solidifying Amex’s position as a leader in restaurant reservations. Rooam is a contactless payment platform offering mobile payments and integration with POS, marketing, and loyalty programs.

Together, these acquisitions allow American Express to provide greater value to their restaurant partners and additional perks for cardholders.

SoundHound AI, a leader in AI voice technology, has acquired Allset, an online ordering provider and restaurant marketplace offering cash back on every pickup order.

This acquisition marks an important step in SoundHound AI’s goal to enable consumers to order food by speaking to cars, TVs, and other systems integrated with their technology.

Over the span of a year, Chowly has acquired Koala and Targetable to expand their tech solutions.

Koala allows Chowly to offer enhanced online ordering for restaurants by providing personalized recommendations and streamlined ordering processes. Targetable is a full-circle marketing platform that does the creative, copy, and ad placements for restaurants so operators can focus on running their restaurants instead of creating ads.

Chowly now offers operators online ordering, automated digital marketing, third-party delivery integration, and more.

SevenRooms, a reservation, CRM, and marketing platform, has acquired HeyPluto, an AI SMS text messaging platform that allows two-way texting between operators and guests.

Acquiring HeyPluto will help operators communicate more effectively with customers, whether for marketing purposes or to send reservation notifications.

ChowNow, a leader in online ordering and marketing specifically for independent restaurants, acquired Cuboh, a company specializing in consolidating online orders from various delivery platforms into a single, easy-to-manage interface.

The acquisition significantly enhances ChowNow’s offerings by integrating Cuboh’s order consolidation and POS integration technology, which helps operators simplify order management and reduce operational headaches.

PAR, the massive restaurant hardware and software tech supplier, acquired TASK and Stuzo.

TASK, an Australian company specializing in food service transaction platforms designed for major brands worldwide, will allow PAR to expand its global reach significantly. Stuzo is a digital engagement software provider for convenience stores and fuel retailers.

With Stuzo, PAR can extend its reach to over 25,000 convenience store sites.

2024 is shaping up to be another amazing year for the foodservice technology industry. Here are several trends we find interesting and worth keeping an eye on.

Digital kiosks are rapidly becoming a restaurant industry staple, particularly in fast-food and quick-service restaurants (QSRs)—Shake Shack now attributes more than half its in-store orders to kiosks.

They offer a simple and efficient way for customers to place their orders directly, which helps restaurants manage rising labor costs, improve overall service speed, and streamline operations. By letting customers order themselves, restaurants need fewer front-of-house staff, which can significantly cut labor costs. This efficiency is crucial at a time when finding and keeping restaurant staff is becoming more difficult and expensive.

Many operators find that customers generally prefer kiosks, too. Many enjoy the convenience of ordering at their own pace without the pressure of a line behind them. Digital kiosks also bring in more money for restaurants—they can suggest additional items or upgrades during the ordering process, often leading customers to spend more than they initially planned. Kiosks also collect data to help restaurants better understand customer preferences and tailor their menus and promotions accordingly.

AI advancements are playing a pivotal role in transforming the restaurant industry in 2024—making front and back-of-house operations more efficient and enhancing customer experiences. One of AI’s most significant impacts is seen in customer service—AI-powered chatbots and virtual assistants are now handling orders, providing personalized recommendations, and managing reservations. This not only speeds up the service but also ensures a more personalized interaction, which can lead to greater customer satisfaction and loyalty.

In back-of-house operations, AI is revolutionizing how restaurants manage their kitchens and inventory. Predictive analytics help forecast demand more accurately, ensuring that restaurants can optimize their stock levels and reduce food waste. In front-of-house, AI helps management schedule employees, take orders and reservations, and manage customer feedback.

Voice AI, one of the fastest-growing sectors, helps employees efficiently oversee reservations and orders from one easy-to-read dashboard, freeing them to focus on creating a more memorable customer experience. Integrating AI into restaurants is not just a passing trend but a significant shift towards more sustainable and efficient operations. As these technologies continue to evolve, their impact on both front-of-house and back-of-house operations will likely grow, setting new standards for the industry far into the future.

Dynamic pricing is a hot topic in the restaurant industry right now, helping businesses adapt to rising costs and shifting consumer behaviors. Traditionally used by airlines, hotels, and eCommerce platforms, dynamic pricing involves adjusting prices based on demand, time of day, and other factors to maximize revenue and efficiency.

Startups like JUICER and Sauce Pricing are at the forefront of this emerging trend, offering dynamic pricing solutions tailored for the restaurant industry. For instance, JUICER leverages AI and machine learning to help restaurants adjust prices in real-time, filling in slower time periods and maximizing profits during peak hours. Early adopters of JUICER’s technology, such as Cali BBQ, have reported significant revenue increases, demonstrating the potential of dynamic pricing to provide meaningful financial benefits. JUICER says it has the potential to benefit operators and customers alike with “data-driven happy hours.”

Dynamic pricing is very appealing to operators looking for a way to fix high labor and operating costs, but its success hinges on properly showing how it benefits customers, too.

It sounds wild, but drone delivery technology is finally starting to hit the market, providing a faster and more efficient way to get customers’ meals. This innovation is especially helpful in urban areas where traffic congestion often delays traditional delivery methods.

Companies like Wing, in partnership with DoorDash, have been at the forefront of this movement. After a successful trial in Australia, they recently expanded their operations to the U.S. These drones can deliver orders in as little as 30 minutes by traveling at speeds of up to 65 mph, then lowering the food gently to the customer’s doorstep using a tether system. This method not only ensures quick delivery but also keeps the food at the optimal temperature.

In addition to drones, autonomous vehicles and robots are becoming more prevalent. Companies like Grubhub and Starship Technologies are testing robot food delivery services in various locations, including university campuses. These robots, about the size of a large cooler, navigate sidewalks to deliver orders, providing a glimpse into a future where autonomous delivery could become commonplace. While the technology is still relatively new and faces challenges such as regulatory hurdles and consumer acceptance, the potential benefits are substantial.

In 2024, the restaurant delivery landscape is being reshaped by unprecedented partnerships among major industry players.

One of the most notable groupings is between Uber Eats and Instacart. This partnership allows Instacart users to order food from Uber Eats’ extensive network of restaurants directly through the Instacart app. This integration aims to streamline the user experience by combining grocery and restaurant deliveries into a single platform, providing greater convenience and potentially increasing order volumes for both companies.

Another significant partnership is between Grubhub and Amazon. This collaboration enables Amazon customers to order food from Grubhub’s restaurant network via the Amazon website and app. The integration is designed to offer Amazon Prime members ongoing benefits, such as free Grubhub+ membership, which includes perks like zero delivery fees and lower service fees. The partnership boosts the benefits for Prime members and expands Grubhub’s reach by connecting with Amazon’s huge customer base.

Seeing so many new startups on the 2024 Brizo Restaurant Tech Map is beyond exciting. As we look ahead to the rest of 2024 and beyond, it’s easy to see that technology is playing a significant role in the future of the restaurant industry. From AI voice reservations to drones delivering meals to your doorstep, we are living in a future we could only dream of before.

Right now, it’s more important than ever to stay in the know on emerging technologies. To understand the market and remain competitive, foodservice vendors and suppliers need accurate, up-to-date market intelligence.

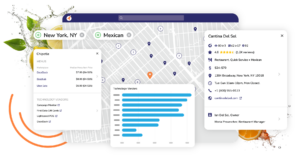

The best way to get that market intelligence is with Brizo FoodMetrics. Gain a comprehensive view of 2.1M+ foodservice establishments, including 1.1K+ in-use restaurant technologies, to improve market clarity, optimize sales productivity, and close more deals.

Stop making business decisions based solely on your own analytics and finger-in-the-wind tactics.

Unlock the full potential of foodservice market data and gain access to detailed, up-to-date market intelligence from the industry’s most reliable source.

Ready to outperform your competition?

Get started with a FREE TRIAL of Brizo FoodMetrics today!